Chamber Board supports Explore La Crosse board: 9% room tax is ok, More is catastrophic

LA CROSSE COUNCIL TO VOTE ON 11% ROOM TAX, UP FROM 8%, Votes April 2 (Committee), April 11 (Council)

As the City of La Crosse approves what will be included in the La Crosse Center remodel for $42 million, they are also looking at how to finance the project. Mayor Tim Kabat wants to offset bonding up to $1.3 million through the increase of the room tax – i.e. a special tax added to hotel room stays. Mayor Kabat originally proposed 12%, has come down to 11%, but publicly said he wants a 10% room tax. His goal is to not increase property taxes.

Chamber: Our Fear

The Chamber agrees that increasing property taxes is not desirable, but a room tax is a small financing option with high risks. We support the findings of Explore La Crosse. 9% is the highest we should go.

Businesses would approach the decision to remodel in order to stay competitive by going straight to increasing prices by 50% to pay for it. An owner would first evaluate competition, explore all funding options, and gently seeing what the market will bear.

Our convention experts/partner, Explore La Crosse know the competition. Their research is highlighted in a sidebar. They say a room tax higher than 9% moves La Crosse to the highest room tax in Wisconsin and will negatively impact our ability to attract the conventions that the Center’s remodel hopes to keep and increase. We cannot doom the La Crosse Center before it opens its doors. Its success impacts all of us. Its failure will put the burden on taxpayers — i.e. what Mayor Kabat is trying to avoid. There are other solutions.

The Mayor is proposing taking the highest risk. The Chamber disagrees and supports Explore La Crosse.

How You Can Help

La Crosse City Council members prefer to hear from La Crosse taxpayers (residential or commercial owner or lease holder).

COME SPEAK

April 2 at 6:00 p.m.

La Crosse City Council Chambers

to the Judicial & Administrative Committee

AND EMAIL BY APRIL 1:

council@cityoflacrosse.org

and copy us in

info@lacrossechamber.com .

It helps us know

what the business community is saying.

WHAT TO SAY

- Your name and role (property owner, taxpayer, etc.)

- Company you are with (if writing as a La Crosse property tax owner) and your La Crosse address

- How the room tax impacts your business directly or indirectly

- Respond with facts, not emotions. Speak to actions, don’t make personal attacks.

- Be clear with what action you want them to take (ex. approve a 9% room tax)

A room tax increase of 1% (to 9%) allows the area to GENTLY assess the impact of an increase

without the City gaining the reputation of being the highest priced rooms in the state and having to repair damage done by raising it too high and too quickly.

Why Non-Tourism Businesses Should Care

- Local companies pay for many of Monday-Friday hotel stays. Clients, job candidates, visiting employees, etc. are housed. This is not just a tax on tourists.

- On every $150 room (inclusive of taxes), hotels must absorb about $4.50 in credit card fees . Businesses pay about 3% of every transaction in credit card fees. The cost to collect the tax must be absorbed by the hotel.

- We are all intertwined. Conventions & tourism fuels restaurants, shops, gas stations, museums, etc. Our businesses that service them will be impacted – ex. mats, uniforms, refreshments, supplies, accounting, legal and financial services, insurance. Those companies service many of us and their employees are our neighbors. Our quality of life will be impacted.

Other Concerns / Information

- Price disparity: La Crosse hotel rooms will cost more than surrounding communities. This tax would only impact La Crosse hotels. La Crosse hotels will have a heavier burden.

- New Hotels Invested in Anticipation of the La Crosse Center/Added Tax Base: The recent boom in downtown is due to the anticipation of the La Crosse Center’s expansion. Five new hotels added 600 new rooms. That additional to the property tax base provides extra funding in the City’s budget. The City would be adding strain on their investment.

Research/Correspondence by Explore La Crosse

Mayor Kabat’s Reasoning

A fact sheet provided by the mayor explained:

- A 4% increase in the room tax would generate $1.3 million.

- Traditionally, the City would finance $35.5 million of the project through general obligation bonds over 20 years, which means $1.8 million in debt + interest per year = $2.7 million/year. They are still pursuing other funding options.

Chamber: Other Options

When we all have an expense that comes up, we look at options similar to the below to pay for it. As with the city, a combination of solutions is often needed:

- Re-allocate funds / prioritize

a) the city’s portion of the room tax to debt reduction (see sidebar)

b) cut expenses in another area of the budget by $2.7 million - Find other revenue sources (the room tax is just one)

OR

increase property taxes. Bearing 100% of the Center’s debt would increase property taxes by $0.68/$1000 assessed value. For a $100,000 home, this is a $68/year increase. For a $1 mil commercial property, this is $680/year increase. This is the least desirable option. - Alternative Financing: There’s discussion of restructure the Center to fall under a Redevelopment Authority, allowing it to finance beyond 20 years, reducing the annual payments, but likely changing the interest paid.

All of these options have not been fully explored or discussed.

Room Tax 101

The room tax at its current 8% raises $2.6 million. Those funds currently go towards:

- 35% funds the La Crosse County Convention & Visitors Bureau (aka Explore La Crosse) = $910k

- 35% funds: 1) La Crosse Center operations = $910k

- 30% goes into the City of La Crosse General Fund =$780k

REMEMBER:

If fewer hotel rooms are sold, $0 taxes are collected. Pricing is a fine balance.

The History:

The Room Tax Created the Convention & Visitors Bureau in 1975

The room tax was created in 1967 by Gov. Warren P. Knowles to fund emergency state aid for local schools. Its creation without clear specifications of what the tax could be used for had the Wisconsin Innkeepers Association opposed the tax.

This prompted an editorial by the La Crosse Tribune.

By April of 1971, the Wisconsin Innkeepers Association, fueled by $500,000 in state funding for tourism, realized they could restrict the funds and add $1.5 million through the room tax. They proposed the room tax be used to build tourism facilities and promote recreational facilities, with the state keeping 25% and passing the rest to municipalities.

At the time, Madison’s room tax was up to 6% with hotels reporting loss of stays to outlying communities and no funding going to tourism efforts (read >>).

A La Crosse City Council Committee first proposed a 3% room, or lodging tax, in November 1971 — and rejected it. The full Council also rejected it a week later (read >>). Motel and hotel owners voiced overwhelming opposition.

Seven months later, a committee of the council again voted down a 3% room tax.

Madison lodging reported a 14.3% loss in business after the room tax as people opted to stay outside the city.

One week later, the effort would officially be rejected by the full Council with fears that a city-only room tax would cause people to stay in surrounding communities (read >>)

By May 1973, Green Bay also created a 3% Room Tax.

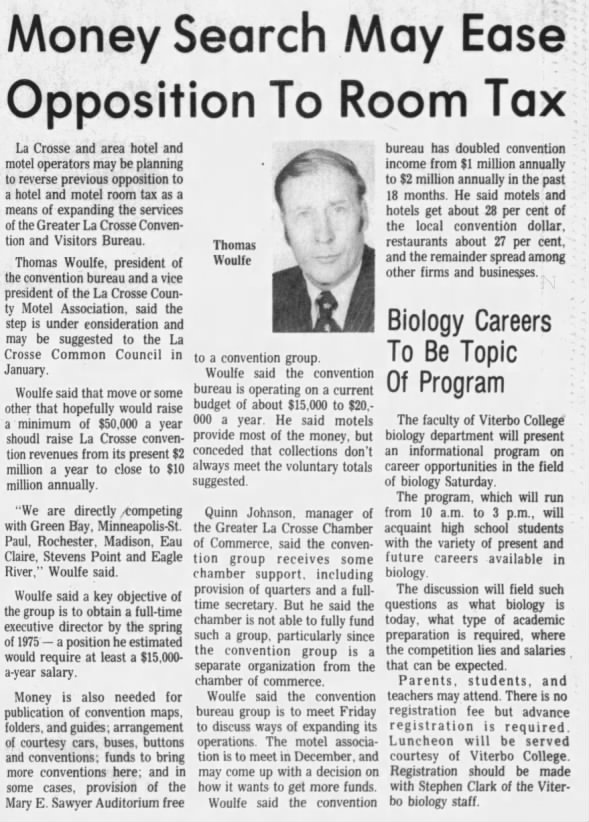

The Chamber and it’s four month old Convention & Visitors Bureau brought in a Green Bay representative to speak to the importance of the tax. This was a pivotal meeting. It changed the conversation around the tax. The Chamber at the time had been struggling to pay for its convention bureau through memberships.

In November of 1973, the Chamber believed the room tax was the solution to its Convention & Visitors Bureau funding problem. Work began to propose the room tax.

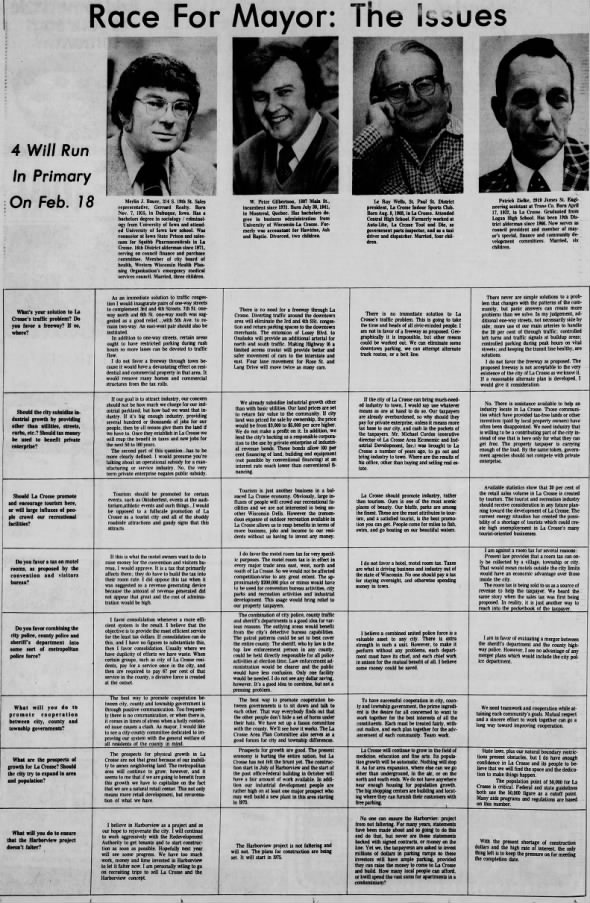

By 1975, the Convention & Visitors Bureau was proposing a room tax with motels and hotels seeming in favor of the tax. This became one of several topics for four mayoral candidates.

Of note: Long-time La Crosse Mayor Pat Zielke’s ts are included, while still a council member and mayoral candidate..

Several side stories included in this same article:

- Traffic congestion was feared

- Economic development incentives were debated

- Some city council candidates interviewed opposed tourism promotion other than for Oktoberfest.

- The Harborview project was feared to be faltering (i.e. the land the La Crosse Center, Radisson and Heileman’s Headquarters (Now Reinhart Foods & 4 Sisters).

With the Chamber’s Convnetion & Visitor’s Bureau now in favor of a room tax, the City Council took up the tax in February of 1975, but deferred it due to lack of clarity on how the funds would be allocated and used.

On March 5, the Chamber determined a formula, but the vote was deferred again because the motels and hotels collectively were not in favor of the tax.

In 1975, about 80% of the hotels were rented by “salesmen” and this was considered a hardship on them.

One week later, the hotels and motels, feeling a tax was inevitable after three prior attempts. They conceded knowing it was being invested to drive business to them.

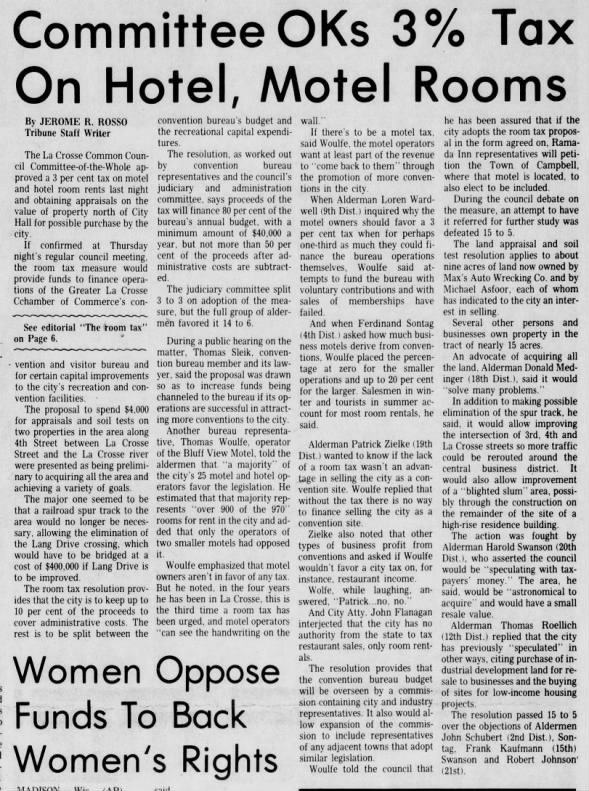

The Chamber’s Convention and Visitor Bureau would work to attract conventions to the City. Certain capital improvements to the city’s recreation and convention facilities would also be funded. The proposal would have:

- 45% going to the Chamber (funding 80% of the bureau)

- 45% to recreational capital budget, and

- the City keeping 10% for administration.

Of the City’s 25 motels and hotels, 23 supported the tax, realizing the number of times it was proposed made it inevitable.

The agreement created a commission of city and industry representatives to oversee the budget/room tax funds.

The Ramada Inn in the Town of Campbell agreed to petition the City to join the room tax.

This sparked a same-day editorial by the La Crosse Tribune.

Within days, the City Council approved the 3% room tax. This was predicted to move the Convention & Visitor’s Bureau budget from $9,000 raised through membership dues to $40,000 raised from the tax.

Part of the agreement with the City was that 20% of the Convention Bureau’s budget had to be raised through membership dues. The Bureau had 51 members. In April, the Chamber ran a membership drive for this funding (read >>). Two weeks later, the La Crosse Area Motel Association voted to join the Bureau (read >>), arguably the beginning of the group’s merger with the Bureau.

Within months, the La Crosse Area Convention & Visitors Bureau was formed with Peter J. Chapman as executive director. The Bureau collected $10,000 in room tax, with another $21,000 expected. By August, the amount collected was $23,905 and the Bureau was able to create a $35,580 budget for 1976 (read >>).